is there a child tax credit for december 2021

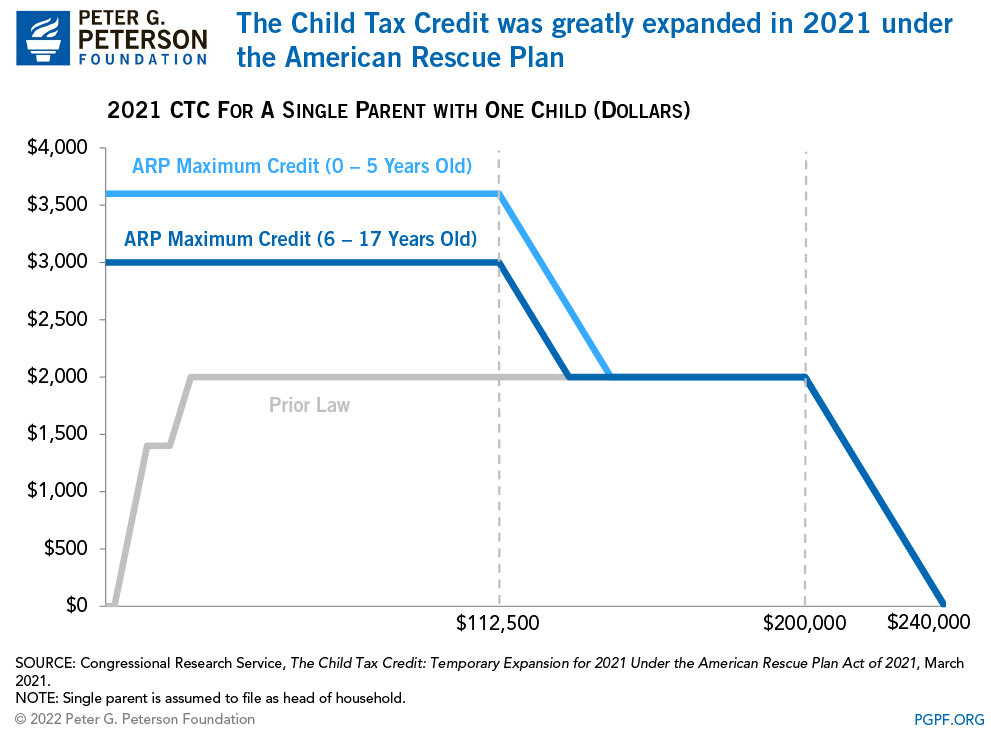

Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17. But patience is needed.

However the deadline to apply for the child tax credit payment passed on November.

. Earned Income Tax Credit. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The 2021 advance monthly child tax credit payments started automatically in July.

10 2021 913 am. The full credit is available for heads of households earning up to 112500 a year. It is not clear whether or not the enhanced credit will be extended into 2022.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Child tax credit for baby born in December 21.

For both age groups the rest of the payment will come with your. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly.

Prior to 2021 the child tax credit provided families with kids ages 0 to 16 with up to 2000 per qualifying dependent. Businesses and Self Employed. The advanced payments will be up to 50 percent of the total.

Report Inappropriate Content. Even though child tax credit payments are scheduled to arrive on certain dates you may not. Families can receive half.

However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to. The total child tax credit of 10500 is correct.

The next to last child tax credit payment will. The payments were split over 6 months with a portion being sent. The American Rescue Plan temporarily boosted the child tax credit just for the 2021 tax year to 3600 for children 5 and younger and 3000 for those 6 through 17.

The Child Tax Credit is an advance payment program of the 2021 tax return for people who are eligible. Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children. And 3000 for children ages 6.

Visualize trends in state federal minimum wage unemployment household earnings more. The next child tax credit check goes out Monday November 15. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit.

If the IRS says the December 2021 child tax credit payment has been made but the money doesnt show up there is a way to trace it. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit. Families who utilized the six monthly advance payments can expect to receive 1800 for each child age 5 and younger and 1500 for each child between the ages of 6 and.

The sixth and final advance child tax credit payment of 2021 goes out Dec. 3600 for children ages 5 and under at the end of 2021. Some people could see a larger child tax credit check in December Published.

In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one. Advanced payments of the 2021 CTC will be made monthly from July through December to eligible taxpayers starting July 15. You have a balance of 6900 for your older children.

Ad Explore detailed reporting on the Economy in America from USAFacts. ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays. Why did you get the.

The IRS is delivering the last round of monthly child tax credit payments in 2021. So there was a lot of talk about the child tax credit in 2021 and many people got advanced payments. This is the first year that 17-year-olds qualify for the CTC.

The credit is not a loan. So who qualifies for this credit. In 2021 this tax credit was increased to provide a maximum of 3600.

Whether payments will continue in 2022 remains to be seen. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of.

What Families Need To Know About The Ctc In 2022 Clasp

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Parents Guide To The Child Tax Credit Nextadvisor With Time

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

2021 Child Tax Credit Advanced Payment Option Tas

Adance Tax Payment Tax Payment Dating Chart

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return