georgia estate tax exemption 2020

Fortunately Georgia is one of 38 states that does not assess estate tax against individuals. For 2020 the estate tax exemption is set at.

Capital Letter No 51 The American College Of Trust And Estate Counsel

After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount.

. The current exemption for all three of these taxes is the same at 117 million in 2021. Georgia Estate Tax Exemption 2020. The federal estate tax exemption is 1170 million in 2021 going up to 1206 million for 2022.

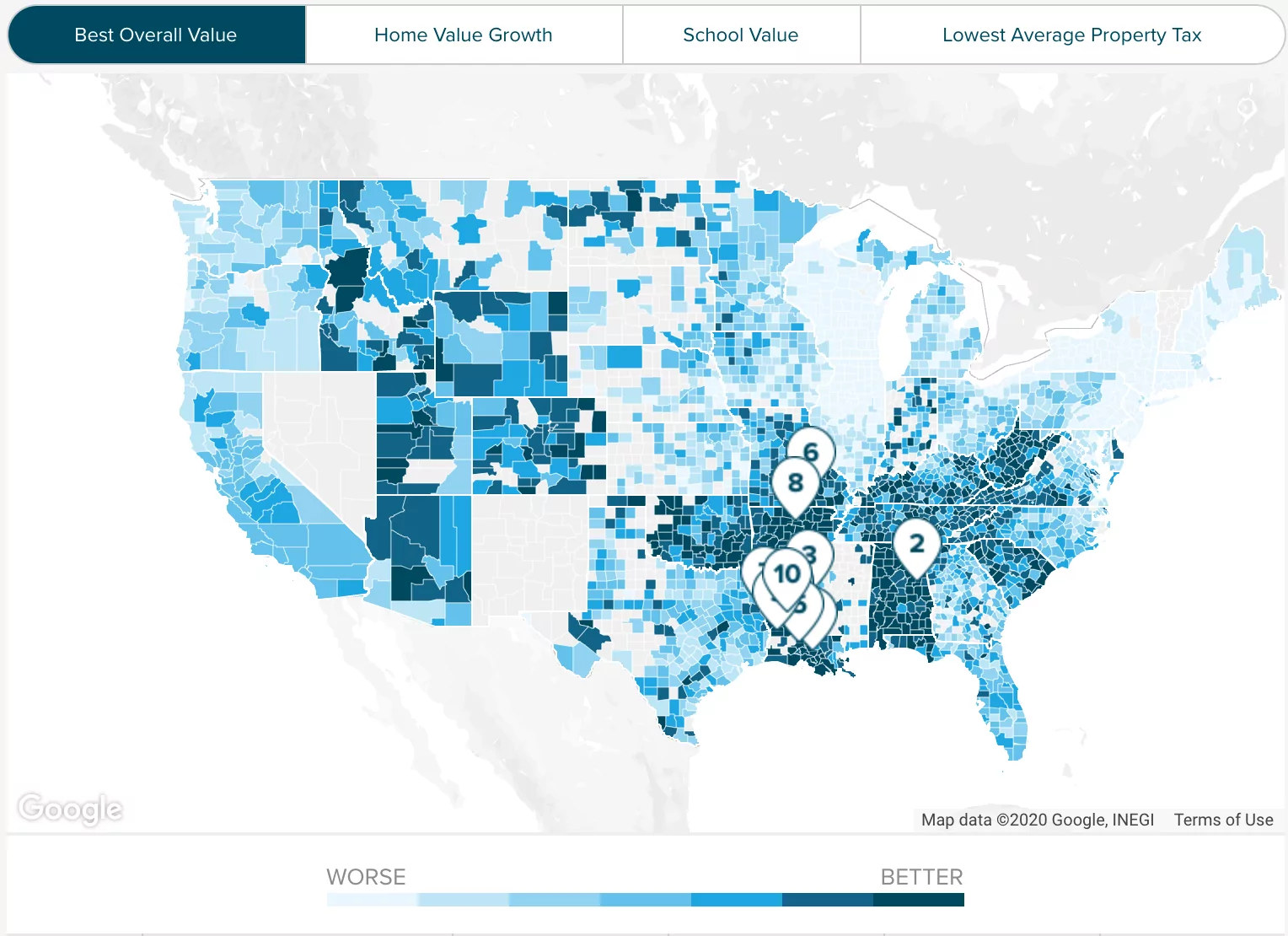

Does Your State Levy Estate and Inheritance Taxes. Two property tax exemption measures. Even though there is no estate tax assessment federal state taxes still exist.

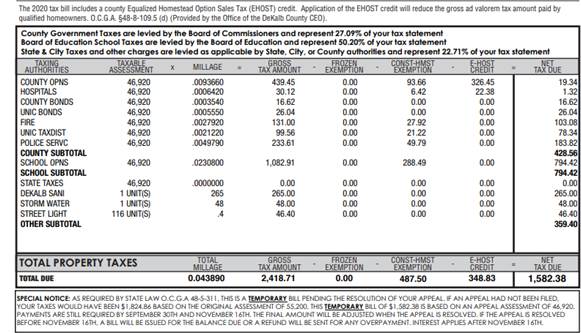

Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. Click the nifty map below to find the current rates. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax.

Excluding certain retirement income. Georgia Estate Tax Rate 2020. The estate tax is still one of the highest tax rates that youll find anywhere in the united states tax code and is.

A federal estate tax is in effect as of 2021 but the exemption is significant. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Property Taxes in Georgia.

For 2020 the estate tax exemption is set at 1158 million for. Find out if state collects either or both taxes on. Georgia Tax Center Help Individual Income Taxes Register New Business.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. Georgia Estate Tax Rate 2020. The current exemption for all three of these taxes is the same at 117 million in 2021.

The current exemption for all three of these taxes is the same at 117 million in 2021. County Property Tax Facts. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. From 2010 through 2018 four property tax exemption measures appeared on the statewide ballot and all were approved. Georgia provides a school property tax exemption to homeowners who are 62 years old or older and have a household income of less than 10000.

The amount for 2019 is 85645. Property Tax Homestead Exemptions. Find out if state collects either or both taxes on.

In Georgia all property is taxed at a rate of 40 of its true market value. Property Tax Returns and Payment. The taxes are replaced by a one.

Georgia homeowners pay approximately 0957 percent of their homes value in property taxes according to the Georgia. Georgia Estate Tax Exemption 2020. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Georgia Estate Tax Exemption.

Eisneramper Use It Or Lose It Estate Planning In 2020 And Beyond

Avoiding Basis Step Down At Death By Gifting Capital Losses

2020 Estate And Gift Tax Exemptions Provenance Law Pllc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What You Need To Know About Georgia Inheritance Tax

Dekalb County Ga Property Tax Calculator Smartasset

Estate Tax Rates Forms For 2022 State By State Table

Georgia Residents Eligible For 3 000 Tax Exemption For Each Unborn Child Fox Rothschild Llp Jdsupra

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Georgia Property Tax Calculator Smartasset

Historical Georgia Tax Policy Information Ballotpedia

Act Before Year End To Preserve Your Current Estate Tax Exemption

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

2019 2020 Estate Planning It S Not Too Late Sgr Law

Exploring The Estate Tax Part 1 Journal Of Accountancy

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation